While the baseball world has been in a frenzy over spring training starting and Manny Machado and Bryce Harper (finally) signing, the Yankees have been busy locking up their young players. In the past few weeks, they have signed Luis Severino to a 4 year $40 million extension and Aaron Hicks to a 7 year $70 million contract.

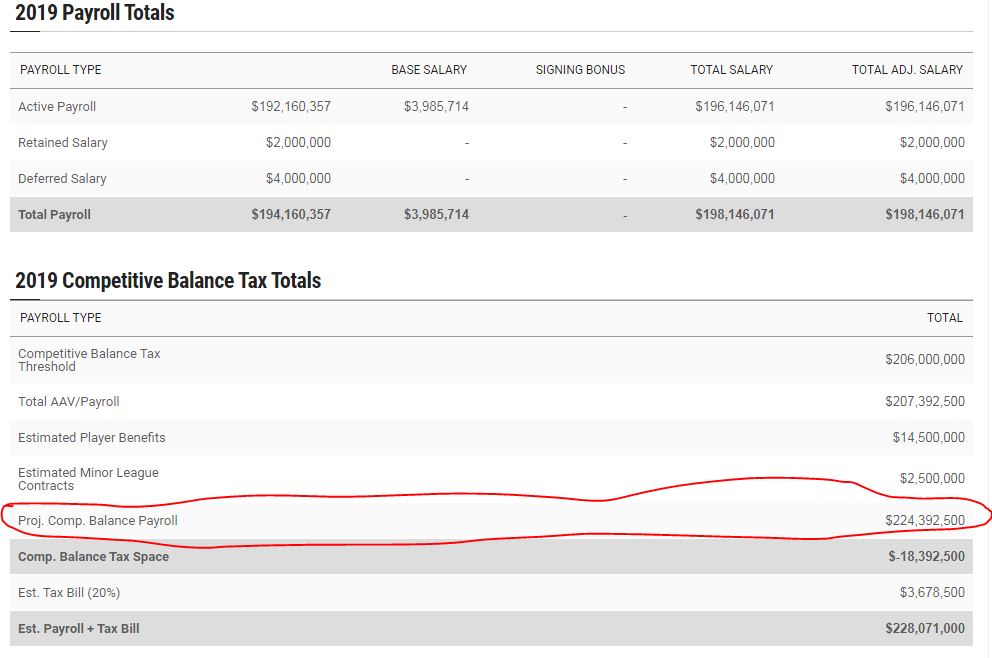

Since we live in the austerity era, my thoughts immediately went to the payroll situation, specifically how these extensions will affect the luxury tax calculation for 2019 and beyond. Hick’s contract added $4 million to this calculation because he had agreed to a $6 million salary for the 2019 season earlier. Severino’s contract is less clear because he was scheduled to go to an arbitration hearing, but his contract likely added about $5 million to the payroll. Thanks to the amazing Spotrac, you can see what the payroll looks like in the chart below:

The important number is the one in red because that is the payroll used to assess the competitive balance salary, or luxury tax. Right now, this estimate has the Yankees at $224 million, which puts them $18 million over the $206 million luxury tax limit and $2 million before the second tier of the tax. The way the tax works is that you pay a 20% tax on the overage of the first $20 million over. Since the Yankees are within that first tier, they pay 20% of that $18 million overage which brings their total expenditure to $228 million. As of now, the Yankees have ~$2 million in salary to work with for other extensions or in-season acquisitions before going into the second tier of the tax.

The second tier of the tax imposes a 12% surfeit tax on the overage in the second bracket. Basically, salary from $206 – $226 million is taxed at 20%, and salary from $226 – $246 million is taxed at 20 + 12 = 32%. Teams that go over the $246 million limit pay 62.5% on that final tier of overage and their first draft pick is moved back 10 places in the next year’s draft.

The reason I laid out all those scenarios is because we’re going to play the what-if game. What if the Yankees signed Manny Machado, Bryce Harper, or both? We now know what they signed for, so we can simply add their salaries into our calculation. Machado signed for $30 million per year and Harper signed for $25.4 million per year. You can see how it would play out in the chart below:

As you can see, signing those big fish free agents would have put the Yankees into the highest tiers of the luxury tax and given them a larger luxury tax bill. Throughout the offseason we wrote about why the Yankees should sign these players, and now that they have signed, we can assess what their financial impact would have looked like. In those types of articles, a common argument was that compared to revenue, the Yankees are spending less and less on payroll. The following table from Reddit shows it:

Even if the actual amount spent on payroll has remained the same, relative to rising revenues, the proportion spent on players has been steadily decreasing. Even if we assume that revenue did not increase last year (which makes no sense because revenues are at an all-time high), the 2018 Yankees spent under 31% of their revenue on payroll. That number placed them last in baseball. That’s right, by this metric, the Yankees spend less on their team than anyone else.

Let’s now take a look at what the proportion of revenue would be had the Yankees signed Machado and/or Harper. For these purposes, we will continue to use the $619 million revenue number to be extra conservative and generous to Hal. Of course, the actual number is likely closer to $650 million or more based on the average of 5% increase in revenue each year.

Even if the Yankees signed BOTH Harper and Machado, they would only be paying out 50% of revenue including luxury tax. And as we saw in the table above, the Yankees in fact did pay about that amount as recently as 2009, when they last won the World Series.

When it comes to payroll, Hal Steinbrenner has been steadfast that you do not need a $200 million payroll to win a World Series. And he’s right. You don’t. But it certainly helps. And to his credit (since I know you read stuff you hear on Twitter, Hal) the Yankees have spent this offseason. But the point I’m trying to make is that spending doesn’t exist in a vacuum, it has to be looked at in terms of revenue as well.

To which Hal told Ron Blum of AP “With no discussion of our costs, that’s always the problem. I hear everything about our revenues, I hear nothing about our cost. I hear nothing about the gargantuan debt service payment that we have to pay every year (on bonds that financed new Yankee Stadium), nothing about all of our stadium operations, all the security, not to mention player payroll, not to mention revenue sharing.”

To which I say lol. If you want to complain that nobody talks about your costs, then actually say what those costs are. As a private company, the Yankees do not have to reveal any cost information beyond the payroll information we have. If you’re not willing to do that, then at least tell us how those costs have changed since the new stadium opened in 2009, which happens to be the last time the Yankees spent close to 50% of revenue on payroll.

Some fans want to criticize players like Machado or Harper for going where the money is. Yet fewer people want to criticize teams and owners for making more money than ever yet spending less. Instead of blaming players for trying to maximize their value, blame owners for trying to take a bigger piece of the pie.

You can contact Rohan on Twitter @rohanarcot20